Takeaways from our Virtual Roundtable

Thomson Reuters recently conducted a virtual roundtable on the future of the tax provision process, featuring Dharmender Chhabra, VP Finance, Corporate Treasury & Taxation, EXL Service and Sameer Prakash, Leader – Tax Technology & Transformation, Ernst & Young, along with tax professionals from India and Southeast Asia.

Our discussion centred on the factors driving the transformation of the global tax provision process and the impactful role that technology can play.

In this article, we explore how corporate tax functions can become more resilient, competitive and profitable at a time when constant disruption and virtual working arrangements have become the ‘next normal’.

In the current climate, a drive to be more resilient and a demand for greater efficiency have accelerated the need for digital transformation in the tax function. The tax provision process is a top priority.

Last year, many companies turned to whatever technology was available to enable remote working arrangements and ensure business continuity in an increasingly virtual world. During 2021, as the global pandemic continues to disrupt processes and productivity, many enterprises are recognising the value of putting agile, digital operating models and robust technologies into place, permanently.

As the need to accelerate digital business journeys takes centre stage, it’s critical not to overlook the tax function. Last year, the sudden thrust into a remote working environment increased pressure on tax professionals. Tax functions that relied on manual processing and data management had to scramble to find new ways of getting work done and managing the flow of tax information, while ensuring transparency and visibility over the global tax provision process.

To successfully navigate the challenges of the future, organisations need to holistically assess their global tax processes within the context of the new virtual, volatile operational environment—and evaluate how approaches can be refined, streamlined and digitised for improved control, accuracy and speed.

During our roundtable, it came to light that tax provisioning is a key area of focus, as it touches processes globally, and should therefore be the first step in any tax transformation journey. The value of accurate, real-time tax provisioning is only accelerating. Monitoring income tax liability is an increasing focus of regulators throughout the world, and investors have long made decisions based on the Effective Tax Rate of a company (one of the widely used KPIs to measure the effectiveness of a tax function).

When one single figure has so many far-reaching consequences, it just has to be right and available on demand. As an opening move, organisations need to understand the challenges faced in arriving at that one figure.

Resolving tax provisioning pain points

In many growing multinational organisations, it can be difficult and time-consuming to integrate and properly structure data, including Trial Balance data, when there are multiple geographical locations with different currencies and file formats to manage. Navigating these complexities manually leaves little time for strategic and analytical activities.

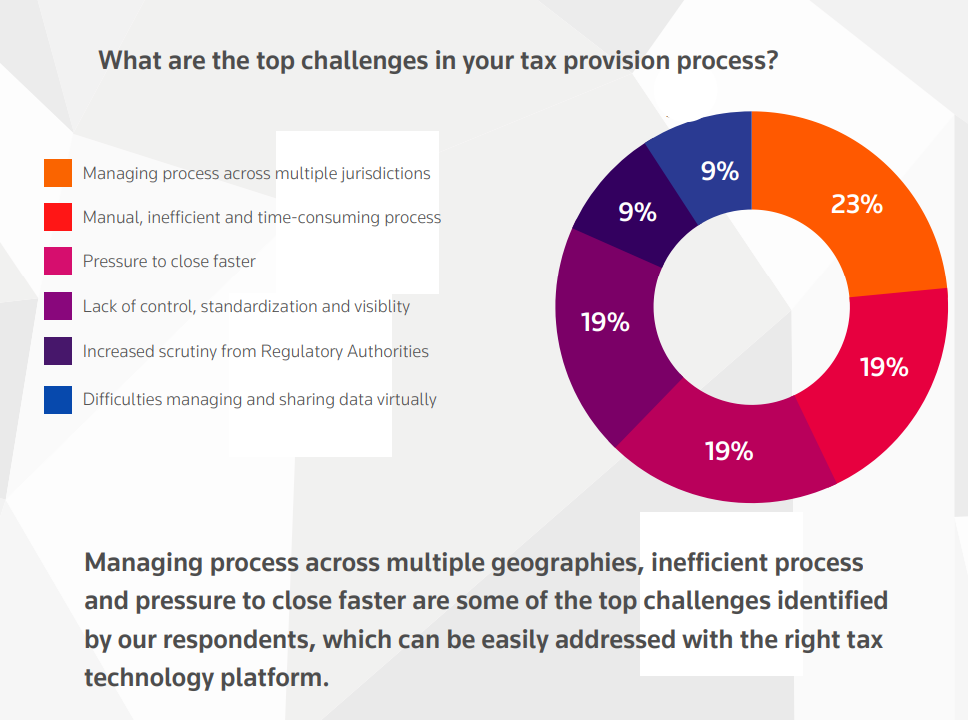

These challenges align with those identified by our roundtable audience. During the virtual event, we conducted a live poll to gather insights from tax professionals in India and South East Asia. When asked to identify the top challenges in their tax provision process, our poll respondents shared the following feedback:

Fortunately, many of these issues can be addressed with a process innovation mindset, supported by a robust and agile tax technology platform.

“To make process transformation a success, it is important to build a transformative culture of learning in the organisation. We need to strive to think outside the box to re-invent processes. It is also important to invest in the right tax platform that provides real-time global visibility and control for your tax teams in order to speed up financial close,” Sameer Prakash advised.

With the right technology solution in place, organisations can resolve key data management challenges and reduce their reliance on disconnected, manual approaches, in order to ensure accurate, streamlined—and even real-time tax provisioning—for a faster financial close.

In turn, this creates more time for tax leaders to focus on analytical activities, while maintaining complete control of their global tax operations.

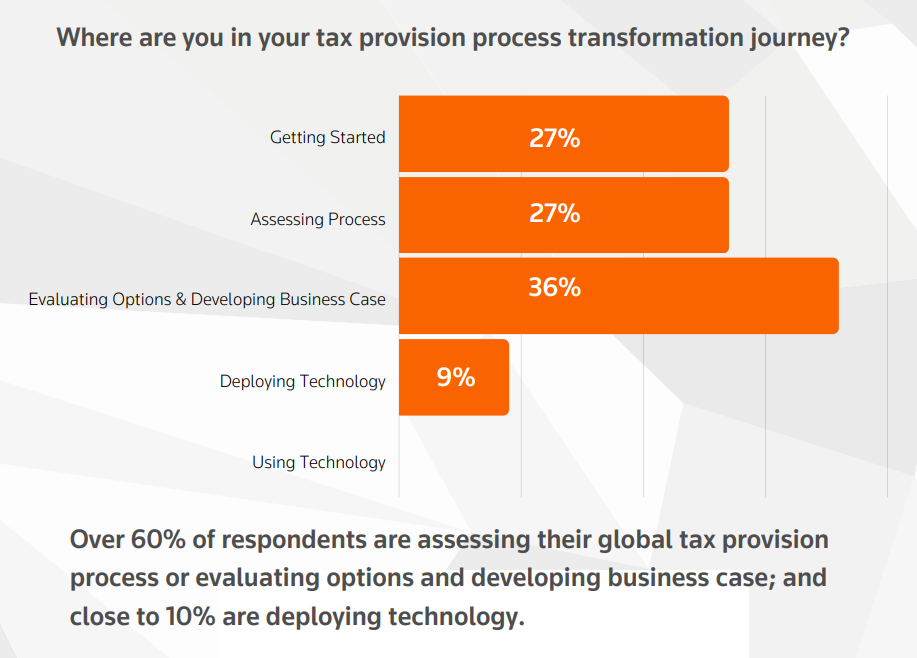

Gauging progress

According to our live poll, over 60% of respondents are making solid progress in their tax provision process transformation journeys, with 27% currently assessing their processes and 36% evaluating options and developing business cases. Close to 10% are already deploying technology.

For those currently—or planning to—build a business case for tax provisioning technology, it is advisable to focus on a range of outcomes beyond pure return on investment (ROI). These include the ability to produce a quick and accurate tax provision, have better control over the process, run different scenarios while having results in real-time, and produce reports and workpapers that support calculations. Another benefit is the ability to report across the company with speed—and spend more time on higher-value activities that grow the business.

While these results may not be as easy to measure as ROI, they are powerful and sustainable advantages that make compelling justifications for investment in a technology platform that automates and streamlines the global tax provision process.

“You may not be able to see the ROI of your transformation initially but along the journey, with the right technology partner, you can re-engineer your process. In the last couple of years, we have grown to leverage technology for our tax provision process more effectively, enhance the skills of our team and overachieve our expectations” Dharmender Chhabra explained.

The road ahead

To successfully navigate the challenges that lie ahead, it is critical for corporate enterprises to build a more efficient, accurate and resilient tax provisioning process—and global tax function as a whole.

Beyond increasing processing speed and overcoming data management hurdles, tax teams can leverage tax provisioning technology to be more agile and resilient in an increasingly virtual working environment and fast-changing tax landscape. At the same time, tax leaders can gain better oversight and control globally, to drive optimal performance across the board.