After 20 years in the trade industry, I can honestly say that filing a customs entry has never been this challenging—or costly.

The recent changes to the United States’ steel and aluminium tariffs, known as Section 232 rules, have created a complex landscape for global trade.

The 25% tariff rate now applies universally, demanding industries adapt to avoid significant penalties and optimise their duty and tax obligations.

Key changes with Section 232 rules

- All countries, including those previously exempt, now face the 25% tariff.

- Expanded requirements for declaring the value of derivative products.

- No drawbacks allowed.

These revised tariffs are in addition to any main or preferential duty rates and other tariffs implemented since the Trump Administration’s second term. This means that even a simple import has become a labyrinth of HS codes for a single commodity.

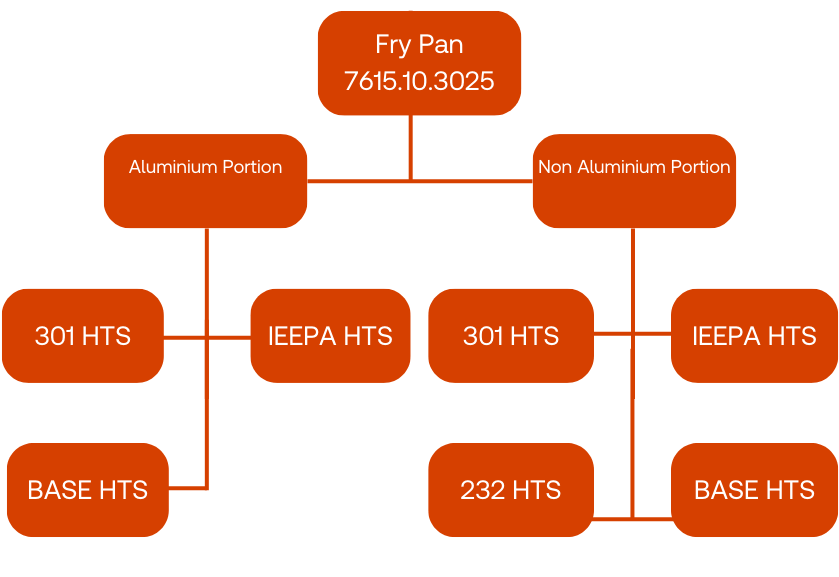

Take, for example, a fry pan: historically, it had a single classification of 7615.10.3025, and duty was paid on the total value. Now, I must determine if Section 301 or IEEPA tariffs apply, assess any aluminium content for Section 232, split the values between two entry lines on my customs declaration, and pay duty for each applicable tariff.

Summary of additional tariffs under chapter 99

| Chapter 99 Tariff | Description | Effective Date |

| 232 | Section 232 tariffs on Steel and Aluminium products | March 12, 2025 |

| 301 v1 | Sec 301 – China Tariffs Actions and Exclusions | Effective from July 2018 |

| IEEPA | US Executive Order Imposing Duties to China | Feb 4, 2025 |

| IEEPA | Additional Duties on Products of Mexico – Executive Order 14194 | March 4, 2025 |

| IEEPA | Additional Duties on Products of Canada – Executive Order 14193 | March 4, 2025 |

| IEEPA | US increase additional duty to China – Executive Order 14195 amended | March 4, 2025 |

Industries are struggling to manage the complexity needed to report derivative values accurately. They risk paying the full 25% without the correct derivative value or face maximum penalties for incorrect classification, with no mitigating factors considered by CBP.

Which industries are impacted?

- Automotive industry: Must report steel content in components like bumpers and body stampings. Derivative products such as aluminium bumpers are affected.

- Construction industry: Uses flat-rolled products, bars, rods, angles, shapes, sections, and sheet piling. Aluminium structures and frames are subject to tariffs.

- Manufacturing and machinery: Bars, rods, and wires used in machinery. Aluminium wire, rods, and tubes are used in electrical and plumbing applications.

- Infrastructure and transport: Rails and plates for railway construction. Tubes, pipes, and hollow profiles for plumbing, oil, and gas transport.

- Appliances and household goods: Stainless steel products for kitchenware. Aluminum cookware and utensils are affected.

- Agricultural equipment: Derivative products like nails and staples used in manufacturing.

How can ONESOURCE be your trade partner in compliance?

It enables you to quickly adapt to changes:

- Offers robust data systems that are crucial for capturing accurate derivative value tracking.

- Helps you prioritise where to focus your time in order to optimise duty and tax obligations

- Helps you maintain compliance, which is key to minimising risk of penalties

Trusted and up-to-date data sets:

- Comprises a single source of truth for product classification data.

- Provides you with an audit trail and captures derivative value information.

- Allows the capture of the multiple tariff codes that may be needed now to import into the United States

Many industries must prioritise accurate classification and reporting of steel and aluminium content to avoid maximum penalties for misclassification. Being able to track and manage derivative value data with confidence will soon become a competitive advantage for businesses in order to keep their costs down versus competition, not dissimilar to utilising a Free Trade Agreement.

This is why it is essential to capture derivative value information and maintain compliance. Utilising a robust data management system helps you minimise duty and tax obligations while navigating the complexities of these new tariffs.

Related articles on global trade management: